A secure retirement plan often includes annuities, which are insurance products that offer you a way to help protect your retirement savings while providing an additional source of retirement income. Given an influx in annuity sales and the current economic landscape, let’s learn more about these financial vehicles. We will review the details on an annuity as well as what could be changing for 2024 annuities!

How does an annuity work?

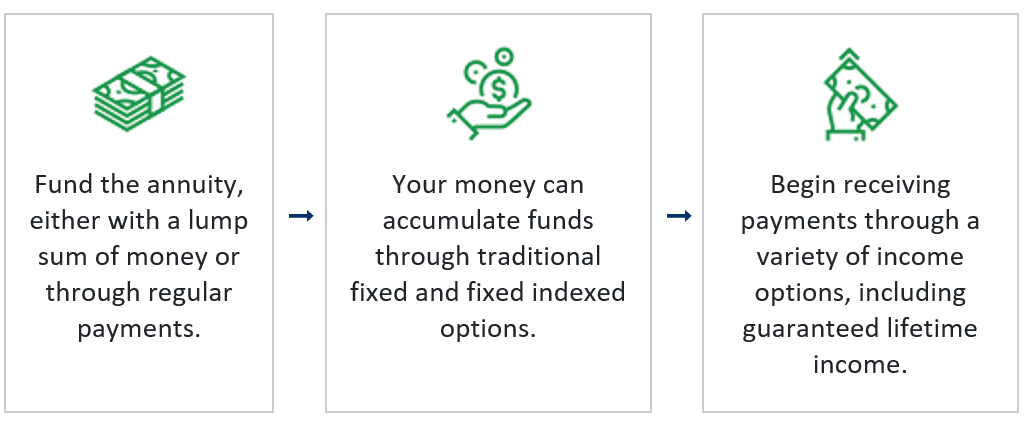

When you purchase an annuity from an insurance company, you agree to fund it, either with a lump sum of money or through regular payments. These contributions generally earn a tax-deferred rate of return as they accumulate.

You then receive income from your annuity, which may be issued monthly, quarterly, annually or in a lump-sum payment. How much you receive with each payment depends on several things, including the length of your payment period, the type of annuity selected, and whether payments are immediate or deferred. You have choices to receive payments in a lump sum, over a fixed period, or for the rest of your life. In some cases, you may be able to pick a combination of these choices. Check out this article for more information on annuity payment options.

What are the different types of annuities?

Here’s a brief rundown on three main types of annuities:

- A fixed interest annuity earns a guaranteed fixed rate of interest.

- A fixed index annuity can earn interest based on an external market index. You’re not actually participating in the market, so the money in your annuity isn’t at risk.

- An immediate annuity is purchased with a lump-sum payment and pays an income stream that starts almost immediately.

What’s changing for 2024 Annuities?

2024 and beyond could present an opportunity for annuities to grow. The first quarter of 2024 produced a 21% increase in annuity sales compared to the prior year. The current economic conditions and investor interest in creating guaranteed retirement income is fueling the growth. LIMRA suggests income-annuity demand will surge from 2024 to 2025.

With the threat of interest rate hikes from the Fed and the current economy, annuities present an option to guard against market fluctuations and secure a consistent income in retirement. Those who anticipate a fixed income in retirement are looking for ways to ensure a seamless and secure transition.

Should you get an annuity?

If you’re in or nearing retirement and you’re concerned about outliving your savings, an annuity may be right for you. Annuities provide many advantages, including:

- Principal protection, even if the market fails to have positive gains.

- Earnings that accumulate on a tax-deferred basis.

- Many flexible payout options that can provide a steady income that you can’t outlive.

- An income stream that won’t affect your Social Security benefits.

Let us know how we can help!

Are you interested in learning more about how an annuity can help ensure your long-term security in retirement? Schedule an appointment with our team today!