Are you worried about what this year’s presidential race will mean for your investments? Are you even considering withdrawing or changing your investments based on who wins in November?

If yes, you’re not alone. CNBC reports that more than half of investors (57%) are feeling anxious about the upcoming election—and 40% expect to move or pull investments based on the election outcome.

Most financial experts, however, don’t recommend making investment decisions based on who wins presidential elections.

Related: 6 Ways to Deal With Election Stress

Don’t Panic: Don’t Make Changes or Pull Investments Based on Candidates

We understand feeling passionate about a candidate—or concerned about how another candidate could affect your investments.

However, it’s important to not change your portfolio or sit on the sidelines based on how you believe a candidate will influence the economy or the stock market.

iShares by BlackRock reminds us that, “Markets don’t vote in elections…they are strictly non-partisan…historically markets have continued to march higher regardless of who holds power.”

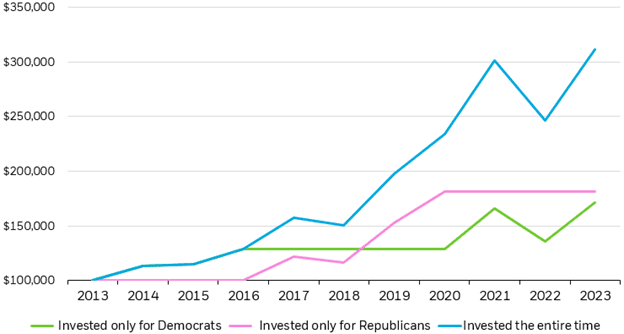

By going to the sidelines, you could miss out on potential growth of your money, and the proof is in the numbers: Investors who stayed the course despite political changes have earned nearly twice as much in the last decade than those who only invest when their party is in office. And over the long run, bipartisan investors earned 31x more than investors who were faithful to their party.

Last 10 years, $100,000 invested in 2013, depending on which party held presidency

Source: BlackRock, Morningstar, as of December 31, 2023. Party presidency period determined by party presidency inauguration to next opposing party presidency inauguration. Stock market represented by the S&P 500 Index from 1/1/70 to 12/31/23 and IA SBBI U.S. large cap stocks index from 1/1/54 to 1/1/70. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in an index.

Chart description: Line chart showing the appreciation of $100,000 invested in U.S. large-cap stocks during democratic presidential terms only, republican presidential terms only, and the entire time, since 2013.

Graph source: https://www.ishares.com/us/insights/investing-in-an-election-year

Stay the Course: Focus on a Diversified Portfolio

During contentious election years like we’re experiencing in 2024, it’s smart to keep a diversified portfolio

Selecting funds that you believe are tied to the fate of a political party isn’t a reliable strategy. Instead, consider allocating to a broad portfolio of high-quality companies that remain resilient over time, regardless of which party is in office.

Related: Prioritizing Investments in the Face of Economic Uncertainty and Inflation

Prioritize Saving in Addition to a Diversified Portfolio

Investors who still feel risk averse can also focus on building a bigger cash reserve. Take advantage of current high rates on high-yield savings accounts and low-risk investments like certificate of deposits (CDs) and bonds. You could also consider an annuity that offers fixed rates and guaranteed income.

Related: Demystifying FINRA: What Investors Need to Know

Final Thoughts

Presidential elections can cause a lot of division and stress, but history shows us that they shouldn’t change the financial plan that you and your Financial Advisor create. Stay the course and be confident that your well-thought-out investment strategy can withstand the uncertainty of an election year.

Want more? Check out our blog, 5 Tips for Investing in an Election Year: Navigating Volatility.

Bankers Life is Here

Bankers Life Securities is here to support your financial goals. Reach out today to chat with a representative.

For information and educational purposes only. Does not constitute investment advice or a recommendation.

Insurers and their representatives are not permitted by law to offer tax or legal advice. The general and educational information here supports the sales, marketing or service of insurance policies. Based upon individuals’ particular circumstances and objectives, they should seek specific advice from their own qualified and duly-licensed independent tax or legal advisors.

Bankers Life Securities, Inc., Bankers Life Advisory Services, Inc., and their representatives do not provide legal or tax advice. Each individual should seek specific advice from their own tax or legal advisors.

Bankers Life is the marketing brand of various affiliated companies of CNO Financial Group including, Bankers Life and Casualty Company, Bankers Life Securities, Inc., and Bankers Life Advisory Services, Inc. Non-affiliated insurance products are offered through Bankers Life Securities General Agency, Inc., (dba BL General Insurance Agency, Inc., AK, AL, CA, NV, PA).

Securities and variable annuities offered through Bankers Life Securities, Inc. Member, FINRA/SIPC (dba BL Securities Inc., AL, GA, IA, IL, MI, NV, PA). Advisory products and services offered by Bankers Life Advisory Services, Inc. SEC Registered Investment Adviser (dba BL Advisory Services, Inc., AL, GA, IA, MT, NV, PA).

Investments are: Not Guaranteed—Involve Risk—May Lose Value.