Wanting to secure the financial future of your loved ones with life insurance is an obvious choice, but selecting the best type of life insurance for your needs isn’t so simple. That’s because there are many kinds of life insurance policies to choose from, each of which has unique advantages and considerations.

Two common types of life insurance policies you may encounter in your research are term life insurance and whole life insurance. Keep reading for information that will help you decide if either of these policies is right for you.

What is term life insurance?

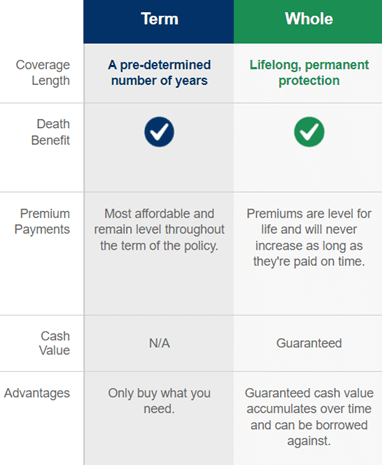

Term life insurance is the most common type of policy. It promises to pay the beneficiary/(ies) of your choice a sum of money (known as a death benefit) in the event you pass away during a certain period of time (known as the term). Common life insurance terms are 10, 20, or 30 years, or to-age-65, and your coverage ends when your term ends.

Term life insurance advantages:

- It’s a great option if you need coverage for a certain time frame, such as the length of your mortgage or until your children are grown.

- It tends to be the most affordable life insurance option and has fixed premiums that don’t change; the average cost of term life insurance is just $26 a month.1

- It’s simple and easy to understand.

- If you die during your policy term, your beneficiary will receive your lump-sum death benefit, which is tax-free for them.

- You can usually cancel a term life insurance policy without incurring penalties.

Term life insurance considerations:

- Your protection stops at the end of your term, and getting a new life insurance policy will likely cost more.

- Term life insurance doesn’t have any savings or investment components.

- If you cancel your policy, you won’t receive any money.

What is whole life insurance?

Whole life insurance is a type of permanent life insurance that offers lifelong protection. That means your beneficiary will receive your death benefit no matter what age you are when you pass away. In addition, whole life insurance features a savings component that allows you to build cash value at a guaranteed interest rate that you can access for any reason.

Whole life insurance advantages:

- It provides lifelong coverage, helping you protect your loved ones from your final expenses and leave a financial legacy.

- It features level premiums that stay the same.

- A policy can build cash value that grows tax deferred, is safe from market loss, and can be accessed.

- If you surrender or terminate your policy, you’ll be paid based on your cash value.

Whole life insurance considerations:

- Whole life insurance tends to cost more than term life insurance; a whole life insurance policy can cost around eight to 12 times more than a 20- to 30-year term life insurance policy.2

- While the death benefit for whole life insurance is tax-free, taxable events can occur, such as when a whole life plan’s cash value exceeds the premiums paid into the policy.2

“Renting versus owning”: What type of life insurance is best for you?

It may be helpful to think about term life insurance and whole life insurance as “renting versus owning.”

- Do you want to “rent” a term policy that provides affordable but temporary coverage?

- Or do you want to “own” a whole life policy that costs more, but provides lifelong protection and financial advantages you can leverage while you’re alive?

Everyone has a unique financial situation and goals, so it’s important to talk to an expert so you can ensure you select the best policy for your needs. Bankers Life is here for you. Get in touch with one of our agents for the support you need!

1Nerdwallet, Average Life Insurance Rates for May 2023, https://www.nerdwallet.com/article/insurance/average-life-insurance-rates, May 2023.

2Center for a Secure Retirement, What Is the Difference Between Term and Whole Life Insurance?, https://www.centerforasecureretirement.com/Posts/What-Is-the-Difference-Between-Term-and-Whole-Life-Insurance, December 2020.