As you age, there may come a day when you need some extra help taking care of yourself. Long-term care is the personal assistance you may need if you’re unable to perform the Activities of Daily Living, or ADLs, on your own for an extended period of time. The six ADLs include:

- Eating

- Bathing

- Dressing

- Transferring

- Toileting (to or from a bed or wheelchair)

- Continence

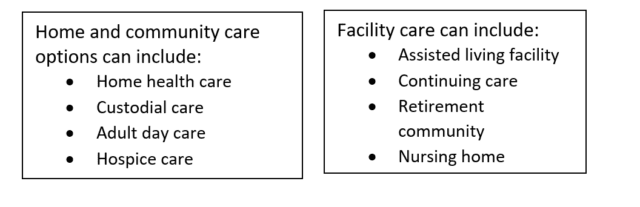

When you hear “long-term care,” you may immediately think “nursing home,” but today there are a wide variety of services available that you may receive at a facility, in the community or in the comfort of your own home.

The cost of long-term care

Long-term care is one of the most expensive costs you may face in retirement, and paying for care out-of-pocket usually requires significant financial assets. Consider these average daily costs of care:1

- Homemaker services: $163 per day

- Home health aide: $169 per day

- Assisted living facility: $148 per day

- Semi-private room in a nursing home: $260 per day

- Private room in a nursing home: $297 per day

What is long-term care insurance?

Most retirees can’t afford to pay for long-term care on their own, so many turn to long-term care insurance. This is a form of health insurance designed to help you pay some of the costs of long-term care services. It can cover your expenses in a variety of settings, from your own home to facility locations, such as adult day care, an assisted living facility or nursing home. Long-term care policies typically reimburse you a monetary daily amount (up to a preselected limit) for assisted care services, such as eating, bathing or dressing.

What’s the difference between Medicare and long-term care insurance?

Many people mistakenly believe Medicare will cover their long-term care needs. However, this largely isn’t true. Here are some main differences between these coverage types:

- Medicare is designed to cover acute care, or the care you need when you’re sick and will eventually recover from your illness. It covers doctor visits, hospital stays and rehabilitative care.

- Long-term care insurance is designed to help cover ongoing custodial care. Custodial care services are assistance with dressing, bathing, eating or other Activities of Daily Living on a regular basis for an extended period of time.

What about Medicare’s skilled nursing facility benefit?

Medicare has a skilled nursing facility benefit that pays part of the cost of skilled care for a limited period of time when the purpose is to help a person recover after a specific medical problem. Under this benefit, skilled nursing care is only covered in full for 20 days and then partially for 21 to 100 days, with no coverage after 100 days. Medicare coverage isn’t intended for skilled care that goes beyond 100 days and typically doesn’t cover custodial care for any period of time.2

Does Medicare cover home health care?

When it comes to Medicare coverage for home health care, the key is whether the care is skilled or not. Medicare doesn’t cover home health aide services (like bathing, dressing and using the bathroom) unless you’re also receiving skilled care such as nursing care or other therapy. Home health aide services are never covered when that is the only care you need.3

Long-term care insurance versus Medicare: The bottom line

Long-term care assistance with Activities of Daily Living is expensive, and Medicare will only temporarily help cover the costs under specific circumstances. Long-term care insurance is specifically designed to help pay the cost of long-term care services by providing coverage directly for facility and home health care.

Have questions about long-term care insurance? We’re here for you!

We recommend consulting with a trusted advisor or an insurance agent that specializes in long-term care before making any insurance purchase. Bankers Life can help you take the next step in preparing your long-term care plan. Contact us here to get paired with a local agent.

1SeniorLiving.org, Nursing Home Costs in 2023, https://www.seniorliving.org/nursing-homes/costs/, 2023.

2Medicare.gov, Skilled nursing facility (SNF) care, https://www.medicare.gov/coverage/skilled-nursing-facility-snf-care, 2023.

3Medicare.gov, Home health services, https://www.medicare.gov/coverage/home-health-services, 2023.

Bankers Life and their licensed agents/producers are not connected with or endorsed by the U.S. government or the federal Medicare program.

Long-term care policies are underwritten by Bankers Life and Casualty Company (Chicago, IL).

ICC23-210431