When it comes to planning for retirement, long-term care is often overlooked. In fact, a recent study revealed that only about one-quarter of adults nearing retirement have seriously considered getting long-term care insurance or a savings account for long-term care expenses. What’s more, more than half of respondents haven’t discussed their long-term care needs and preferences with their family or friends.1

Why aren’t Americans preparing for long-term care? For many, common myths and misconceptions are preventing them from being prepared. Check out these six common long-term care myths that could impact your retirement.

MYTH #1: I won’t need long-term care.

REALITY: Needing help with Activities of Daily Living—eating, bathing, dressing, transferring, toileting and continence—may seem like an unlikely scenario. But the reality is, roughly 70% of people aged 65 and older will need some type of long-term care during their lifetime.2

MYTH #2: My family will take care of me.

REALITY: Long-term care facilities are full of people whose families intended to care them, but ultimately couldn’t for a variety of reasons. Physical, financial and geographical limitations are common reasons why people can’t care for their aging relatives, even if they had the best intentions to in the first place. That’s why it’s important to have a plan and be prepared to pay for the long-term care you may need someday.

MYTH #3: Medicare will cover my long-term care.

REALITY: Medicare is designed to cover acute care, or the care you need when you’re sick and will eventually recover from an illness. It doesn’t cover ongoing Activities of Daily Living services when those are the only care you need.

Long-term care insurance is designed to help cover ongoing custodial care. Custodial care services are assistance with dressing, bathing, eating or other Activities of Daily Living on a regular basis for an extended period of time.

MYTH #4: I’ll use my Social Security benefits to pay for Long-Term Care

REALITY: Long-term care is expensive, with homemaker services costing $163 per day on average and a semi-private room in a nursing home costing $260 per day on average.3 Even the maximum monthly Social Security benefit of $3,6274 won’t cover these amounts.

MYTH #5: Nursing homes are the only option.

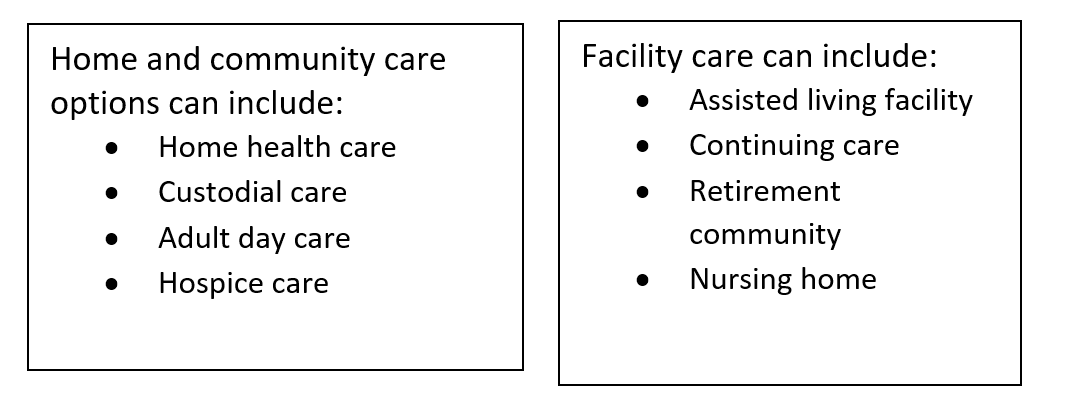

REALITY: When you hear “long-term care,” you may immediately think “nursing home,” but today there are a wide variety of services available that you may receive at a facility, in the community or in the comfort of your own home.

Owning long-term care insurance can help ensure you receive the care you need on your terms—where and how you want it.

Owning long-term care insurance can help ensure you receive the care you need on your terms—where and how you want it.

MYTH #6: I will get long-term care insurance later, when I need it.

REALITY: Qualifying for long-term care insurance coverage after you’re diagnosed with an illness is very difficult. Applying for long-term care insurance at a younger age helps you qualify for coverage and lock in lower premiums. Many people purchase long-term care insurance in their 50s. This helps them secure their coverage when they’re in good health and lock in more affordable premiums.

We can help you bust myths and plan for a secure retirement!

Being aware of these common long-term care myths can help you improve upon your financial security in retirement. Our team of experts can help you build a long-term care plan that provides security and peace of mind. Contact us here to get paired with a local Bankers Life agent.

1Forbes, Most American are Unprepared for Long-Term Care Costs, New Research Shows, https://www.forbes.com/sites/debgordon/2022/08/02/most-americans-are-unprepared-for-long-term-care-costs-new-research-shows, August 2022.

2U.S. Department of Health and Human Services, How Much Care Will You Need?, https://acl.gov/ltc/basic-needs/how-much-care-will-you-need, 2020.

3SeniorLiving.org, Nursing Home Costs in 2023, https://www.seniorliving.org/nursing-homes/costs/, 2023.

4Social Security Administration, What is the maximum Social Security retirement benefit payable?, https://faq.ssa.gov/en-us/Topic/article/KA-01897, 2023.