Do you ever feel like the only person in the room who doesn’t understand retirement savings tools?

We assure you, you’re not alone. A recent survey found that 26% of respondents don’t have a strong understanding of what to do when it comes to retirement planning.1

In other words, you’re in good company!

The truth is, saving for retirement can feel complex and overwhelming, and many people would rather kick the can down the road and figure it out later. However, for most people, a secure retirement requires decades of scrupulous saving, and there’s no better time than today to start prioritizing your retirement!

To help you get started on your journey toward a more secure retirement, we’re going to share a simple, high-level rundown on three common retirement savings options: traditional IRA, Roth IRA and 401(k).

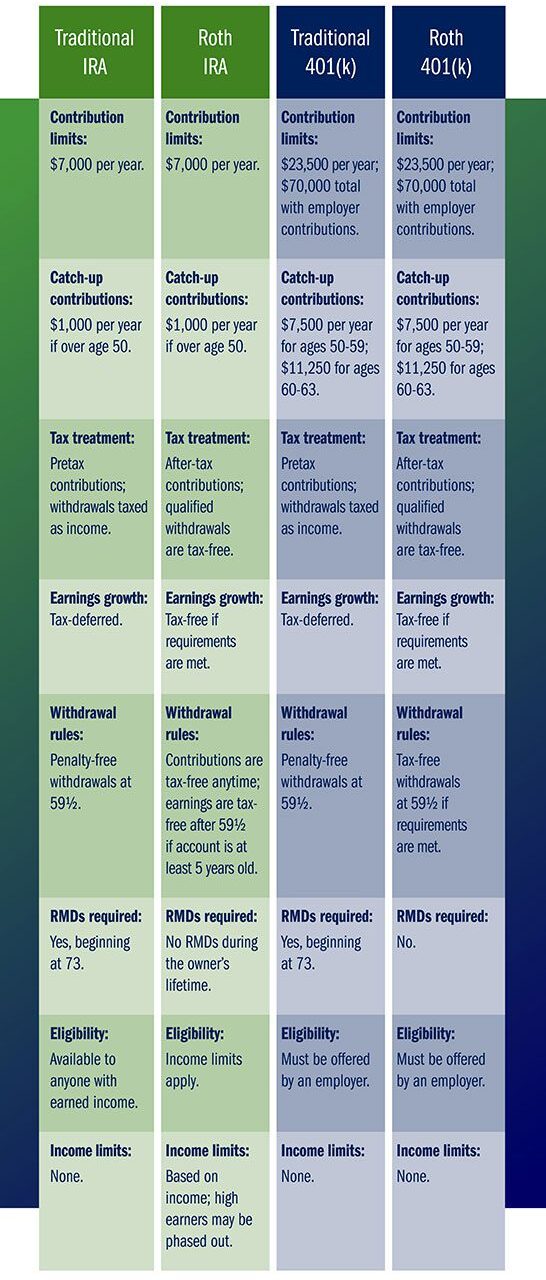

Types of Retirement Accounts: 401(k) vs IRA

Saving for retirement is a great step toward securing your financial future, and understanding your options can make all the difference. Whether you’re interested in tax-deferred growth or tax-free withdrawals, there’s a retirement account designed to help build the retirement you want.

Use this chart to compare common types of retirement accounts so you can choose the option that aligns with your goals.

Understanding your retirement account options is just the first step. Let a Bankers Life Advisory Services Investment Advisor help you create a personalized solution to provide long-term success.

What is a traditional IRA?

A traditional individual retirement account (IRA) is a savings tool that you can open through a bank, brokerage firm, federally funded credit union, or savings and loan association. There are no income or age restrictions on a traditional IRA.

A traditional IRA allows you to contribute pre-tax or after-tax dollars. The money in your traditional IRA grows through annual contributions and through investment gains. Your money can grow tax-deferred, which means you won’t pay taxes on it until you begin taking withdrawals. And depending on your income level or if you don’t have a 401(k), your contributions may be current-year tax deductible, helping give you immediate tax benefits.

In 2023, annual IRA contributions are limited to $6,500 a year, with a $1,000 catch-up contribution if you’re over age 50. Keep in mind that investments held in an IRA often don’t guarantee performance, so the balance of your IRA may increase or decrease over time as your investments fluctuate in value.

With a traditional IRA, you can begin taking withdrawals from your account at age 59½; these will be penalty-free, but taxed as current income. And mandatory distributions begin after age 73.

What is a Roth IRA?

A Roth individual retirement account (IRA) is a savings tool that you can open through a bank, brokerage firm, federally funded credit union, or savings and loan association. There is no age restriction on a Roth IRA, but to be eligible to contribute, you must earn income below a certain level ($153,000 for single tax filers, or less than $228,000 for those married and filing jointly).

A Roth IRA allows you to contribute after-tax dollars. The money in your Roth IRA grows through annual contributions and investment appreciation, with annual contributions limited to $6,500 a year ($7,500 if you’re over age 50). Contributions and potential investment gains accumulate tax-free. Unlike the traditional IRA, the Roth IRA doesn’t offer any current-year tax benefits.

Like traditional IRAs, Roth IRAs usually don’t guarantee performance, so your investments could fluctuate in value.

For the Roth IRA, you can begin taking penalty- and tax-free withdrawals from your account after five years and age 51½, with no age for mandatory distributions.

What is a 401(k)?

A 401(k) is a retirement savings tool that may be offered by your employer.

There are two main types of 401(k)s, traditional and Roth. And, you guessed it, the main difference is that a traditional 401(k) is funded with pre-tax dollars, while a Roth 401(k) is funded with after-tax dollars.

The money in your 401(k) grows through your contributions, which are usually a percentage of each paycheck paid directly into an investment account. In 2023, the annual limit on employee contributions is $22,500 for workers younger than 50. Workers over the age of 50 can make an additional $7,500 catch-up contribution.

Your value may also grow through employer matching. If you have a Roth 401(k), your employer may match your retirement contributions up to a certain amount. However, matching contributions to a Roth 401(k) must be placed in a separate pre-tax 401(k).

The money in your 401(k) also grows through investment earnings. You may have the option to choose among several investment options, usually an assortment of stock and bond mutual funds and target-date funds.

In general, you can begin withdrawing from your 401(k) at age 59½, or if you meet other criteria dictated by the IRS. If you have a traditional 401(k), your withdrawals will be taxed as ordinary income. If you have a Roth, you’ve already paid taxes and will not owe additional tax on withdrawals, as long as you satisfy certain requirements.

Saving for retirement is complex, but you don’t have to go it alone.

Let a Bankers Life Advisory Services Investment Advisor help guide you through the challenges of investing. Our team can help you create a personalized solution built to provide long-term investment success! Learn more about us here.

1Kiplinger, Are You Confident About Your Retirement Prospects, https://www.kiplinger.com/retirement/are-you-confident-about-your-retirement-prospects, May 2023.

Bankers Life Securities, Inc., Bankers Life Advisory Services, Inc., and their representatives do not provide legal or tax advice. Each individual should seek specific advice from their own tax or legal advisors.

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Bankers Life is the marketing brand of various affiliated companies of CNO Financial Group including, Bankers Life and Casualty Company, Bankers Life Securities, Inc., and Bankers Life Advisory Services, Inc. Non-affiliated insurance products are offered through Bankers Life Securities General Agency, Inc., (dba BL General Insurance Agency, Inc., AK, AL, CA, NV, PA).

Securities and variable annuities offered through Bankers Life Securities, Inc. Member, FINRA/SIPC (dba BL Securities Inc., AL, GA, IA, IL, MI, NV, PA). Advisory products and services offered by Bankers Life Advisory Services, Inc. SEC Registered Investment Adviser (dba BL Advisory Services, Inc., AL, GA, IA, MT, NV, PA).

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Investments are: Not Guaranteed—Involve Risk—May Lose Value.

Sources:

https://www.irs.gov/newsroom/401k-limit-increases-to-23500-for-2025-ira-limit-remains-7000

https://www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs

https://www.irs.gov/retirement-plans/roth-comparison-chart

Bankers Life is the marketing brand of various affiliated companies of CNO Financial Group including, Bankers Life and Casualty Company, Bankers Life Securities, Inc., and Bankers Life Advisory Services, Inc. Non-affiliated insurance products are offered through Bankers Life Securities General Agency, Inc., (dba BL General Insurance Agency, Inc., AK, AL, CA, NV, PA).