Imagine two people who both have a family history of Alzheimer’s disease. One person lives in Lexington, Kentucky. The other lives in Carson City, Nevada.

Despite sharing a similar predisposition for the disease, the person who lives in Lexington, Kentucky, is 36% more likely to be diagnosed with Alzheimer’s disease or another form of dementia than the person in Nevada.

But why is this the case?

Researchers from the University of Michigan Medical School analyzed Medicare claims for nearly five million older adults across the country and found that some health care systems are doing a better job of screening and diagnosing Alzheimer’s disease or other dementias and referring patients to specialists.

They found that people who live in regions with the highest diagnostic intensity are 36% more likely to be diagnosed with Alzheimer’s, while people who live in the lowest diagnostic intensity are 28% less likely to get a timely diagnosis.

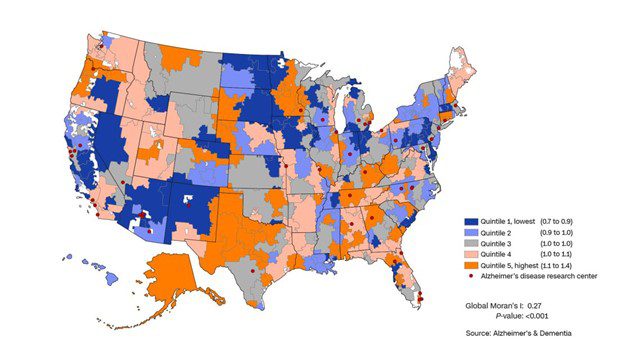

CNN created this map based on the study, which shows how likely people in regions are to get a timely dementia diagnosis. People who live in the dark orange areas are the most likely to get a timely diagnosis, while people who live in the dark blue areas are the least likely.

So, depending on your ZIP code, you may be more or less likely to get an early diagnosis—and when it comes to Alzheimer’s, early diagnosis is important.

According to the Alzheimer’s Association, an early diagnosis allows you:

- Access to treatment options that may help lessen symptoms.

- An opportunity to participate in clinical trials that are advancing research and may provide medical benefits.

- A chance to prioritize your health and make changes that may help preserve your cognitive function, such as controlling blood pressure, stopping smoking, exercising, and staying mentally and socially active.

- More time for you and your family to plan for the future, deciding what you want during each stage of the disease and ensuring your legal and financial matters are in order.

- Possible cost savings, as diagnosis during mild cognitive impairment, before dementia, is shown to result in lower medical and long-term care costs.

- More opportunities to maximize your time with your family and access support programs, which can help improve your emotional and social health.

Take Control of Your Cognitive Health & Future

Even if you live in one of the dark blue areas on the map, being knowledgeable about Alzheimer’s disease and the resources available to you can help you take control of your cognitive health and future. Here are three things you should know:

1. Be Aware of Early Signs of Alzheimer’s and Dementia

Everyone should know the early signs of Alzheimer’s disease, whether or not they have a family history. Check out this resource from the Alzheimer’s Association that shares 10 early warning signs and symptoms. If you notice any of them in yourself or another person, schedule an appointment with a doctor.

2. Take Advantage of Medicare Screenings & Advocate for Cognitive Assessments

Medicare provides all members with a free annual wellness visit, which may include a cognitive assessment.

Whether or not a cognitive assessment is conducted depends on the doctor. Advocate for yourself and call around to find a doctor who will give you a cognitive assessment during this yearly visit to look for signs of dementia.

In addition, Medicare Part B covers a separate visit with a doctor to fully review your cognitive function, establish or confirm a diagnosis like Alzheimer’s disease, and develop a care plan. For this visit, you’ll pay your Part B deductible if you haven’t met it. If you have met your deductible, you’ll pay 20% of the Medicare-Approved amount.

Related: Be Sure to Take Advantage of These Free Medicare Services

3. Consider Long-Term Care Insurance

Whether it’s due to Alzheimer’s, a different illness, injury, or simply aging, about 70% of people will need some type of long-term care in their lifetime.

Paying for long-term care out of pocket requires significant financial assets, and many don’t qualify for Medicaid-covered nursing home care. That’s where long-term care insurance can help. This type of policy is designed to help pay for the long-term care services policyholders need. It typically reimburses policyholders a monetary daily amount (up to a pre-selected limit) for assisted care services (such as eating, bathing or dressing).

Related: Long-Term Care Insurance vs. Medicare: What’s the Difference?

Long-term care insurance is a wonderful option for helping to protect the wealth and dignity of seniors; however, it’s very difficult for someone who’s already old, injured or ill to qualify for coverage.

That’s why it’s important to plan ahead. Many professionals recommend people purchase long-term care insurance in their mid-50s so they can qualify for coverage and lock in lower premiums.

Want more? Check out our blogs, Caring For A Loved One With Alzheimer’s: 4 Tips For Family Caregivers and How to Talk to Your Aging Parent About Long-Term Care.

We’re here for you!

Bankers Life is here to help customers with their financial and insurance needs so please visit us at BankersLife.com to learn more.